Everything About Corporate Voluntary Agreement (CVA): Meaning and Use.

Everything About Corporate Voluntary Agreement (CVA): Meaning and Use.

Blog Article

Ultimate Overview to Understanding Business Voluntary Contracts and Exactly How They Benefit Services

Corporate Voluntary Agreements (CVAs) have become a tactical tool for services looking to browse financial obstacles and restructure their procedures. As business landscape continues to advance, comprehending the complexities of CVAs and just how they can positively influence firms is essential for educated decision-making. cva meaning business. From supplying a lifeline to struggling organizations to fostering a course in the direction of lasting development, the benefits of CVAs are multifaceted and tailored to resolve a range of business requirements. In this guide, we will certainly check out the subtleties of CVAs, clarifying their benefits and the procedure of application, while additionally delving into vital factors to consider that can make a significant distinction in a company's economic wellness and future potential customers.

Comprehending Corporate Voluntary Contracts

In the world of corporate administration, a basic concept that plays an essential function in shaping the partnership between stakeholders and business is the detailed device of Business Volunteer Arrangements. These arrangements are voluntary commitments made by firms to adhere to certain standards, techniques, or goals past what is legally required. By participating in Business Voluntary Contracts, firms demonstrate their dedication to social responsibility, sustainability, and moral business practices.

Advantages of Business Volunteer Contracts

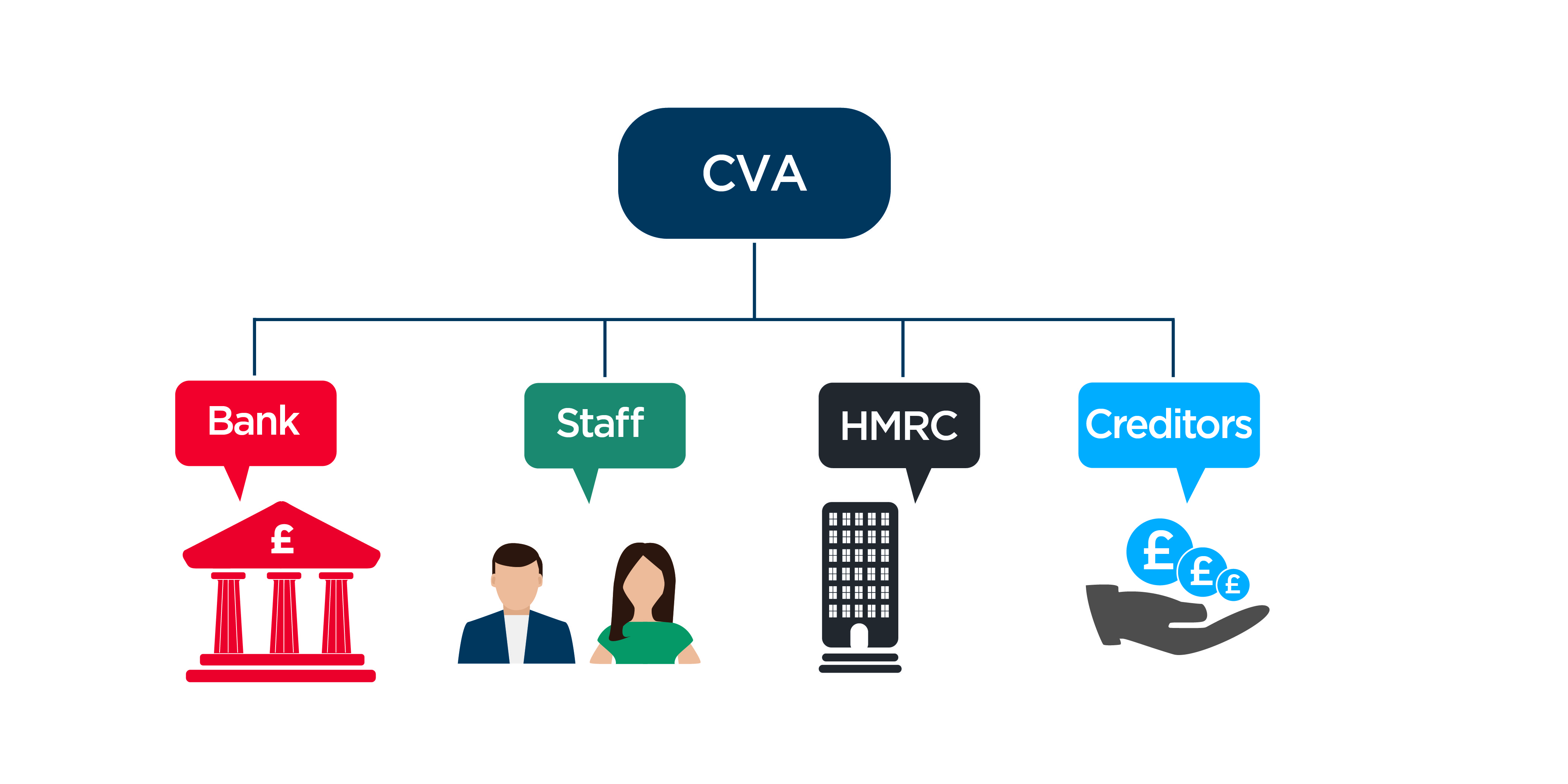

Moving from an exploration of Company Volunteer Contracts' relevance, we now turn our focus to the tangible advantages these arrangements offer to companies and their stakeholders. One of the main advantages of Corporate Voluntary Contracts is the possibility for companies to restructure their financial debts in a more workable means.

Furthermore, Corporate Volunteer Contracts can enhance the firm's online reputation and relationships with stakeholders by showing a commitment to resolving economic difficulties sensibly. Generally, Corporate Volunteer Contracts offer as a calculated tool for firms to navigate economic obstacles while preserving their procedures and relationships.

Refine of Executing CVAs

Comprehending the process of executing Business Voluntary Contracts is vital for business seeking to navigate financial challenges effectively and sustainably. The first step in carrying out a CVA includes designating a certified insolvency practitioner that will you can try this out certainly work closely with the company to analyze its financial situation and stability. Throughout the execution procedure, routine communication with financial institutions and thorough monetary management are vital to the effective execution of the CVA and the company's ultimate monetary healing.

Key Factors To Consider for Services

When assessing Corporate Volunteer Agreements, businesses need to meticulously take into consideration essential factors to make certain successful economic restructuring. One vital consideration is the sustainability of the recommended payment strategy. It is important for businesses to examine their capital projections and make certain that they can satisfy the agreed-upon settlements without endangering their procedures. Additionally, organizations must thoroughly examine their existing debt framework and evaluate the effect of the CVA on numerous stakeholders, including financial institutions, staff members, and providers.

An additional crucial consideration is the level of openness and interaction throughout the CVA process. Open and honest interaction with all stakeholders is crucial for building trust and making certain a smooth application of the agreement. Organizations must also take into consideration seeking professional suggestions from monetary consultants or lawful experts to navigate the intricacies of the CVA process properly.

Additionally, companies require to analyze the long-term effects of the CVA on their track record and future funding opportunities. While a CVA can provide instant alleviation, it is crucial to review exactly how it might affect connections with financial institutions see and investors in the future. By meticulously considering these crucial variables, services can make educated decisions relating to Corporate Voluntary Contracts and set themselves up for an effective financial turn-around.

Success Stories of CVAs at work

Numerous businesses have effectively applied Corporate Voluntary Contracts, showcasing the efficiency of this economic restructuring device in revitalizing their operations. One noteworthy success tale is that of Firm X, a battling retail chain facing bankruptcy due to installing financial obligations and decreasing sales. By becoming part of a CVA, Business X was able to renegotiate lease contracts with proprietors, lower expenses prices, and restructure its financial obligation commitments. Because of this, the firm had the ability to support its monetary setting, enhance money flow, and prevent insolvency.

In an additional circumstances, Firm Y, a manufacturing firm strained with tradition pension liabilities, made use of a CVA to rearrange its pension commitments and streamline its operations. Via the CVA procedure, Company Y achieved substantial expense savings, boosted its competitiveness, and safeguarded long-lasting sustainability.

These success stories highlight just how Business Voluntary Arrangements can offer struggling organizations with a feasible path in my review here the direction of financial recuperation and operational turn-around - what is a cva in business. By proactively addressing economic difficulties and reorganizing obligations, firms can emerge more powerful, more active, and better placed for future development

Conclusion

In conclusion, Corporate Voluntary Agreements offer businesses a structured approach to resolving financial difficulties and restructuring debts. By executing CVAs, companies can avoid insolvency, shield their properties, and keep partnerships with lenders.

In the realm of corporate governance, a basic principle that plays an essential function in shaping the partnership in between business and stakeholders is the elaborate mechanism of Company Volunteer Contracts. By entering right into Business Voluntary Arrangements, firms demonstrate their commitment to social obligation, sustainability, and honest business techniques.

Relocating from an exploration of Company Volunteer Agreements' value, we currently turn our focus to the concrete advantages these arrangements provide to companies and their stakeholders.Furthermore, Business Volunteer Arrangements can boost the company's reputation and connections with stakeholders by demonstrating a dedication to addressing financial obstacles sensibly.Understanding the procedure of carrying out Business Volunteer Agreements is crucial for business looking for to navigate economic challenges properly and sustainably.

Report this page